Stock Insights Dashboard

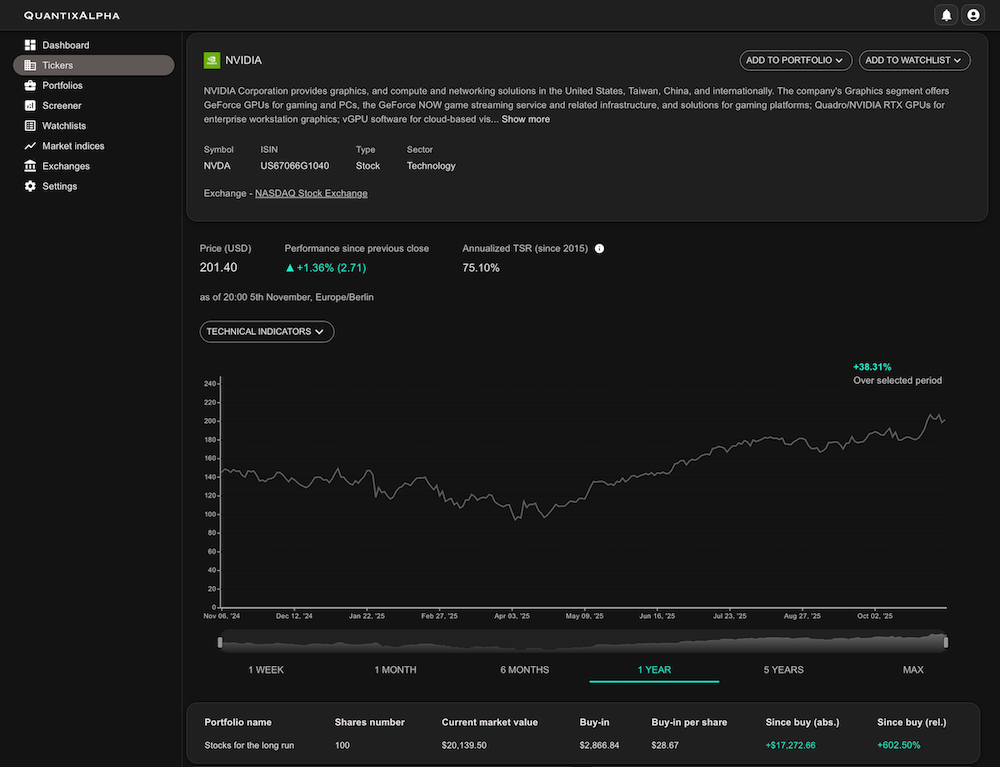

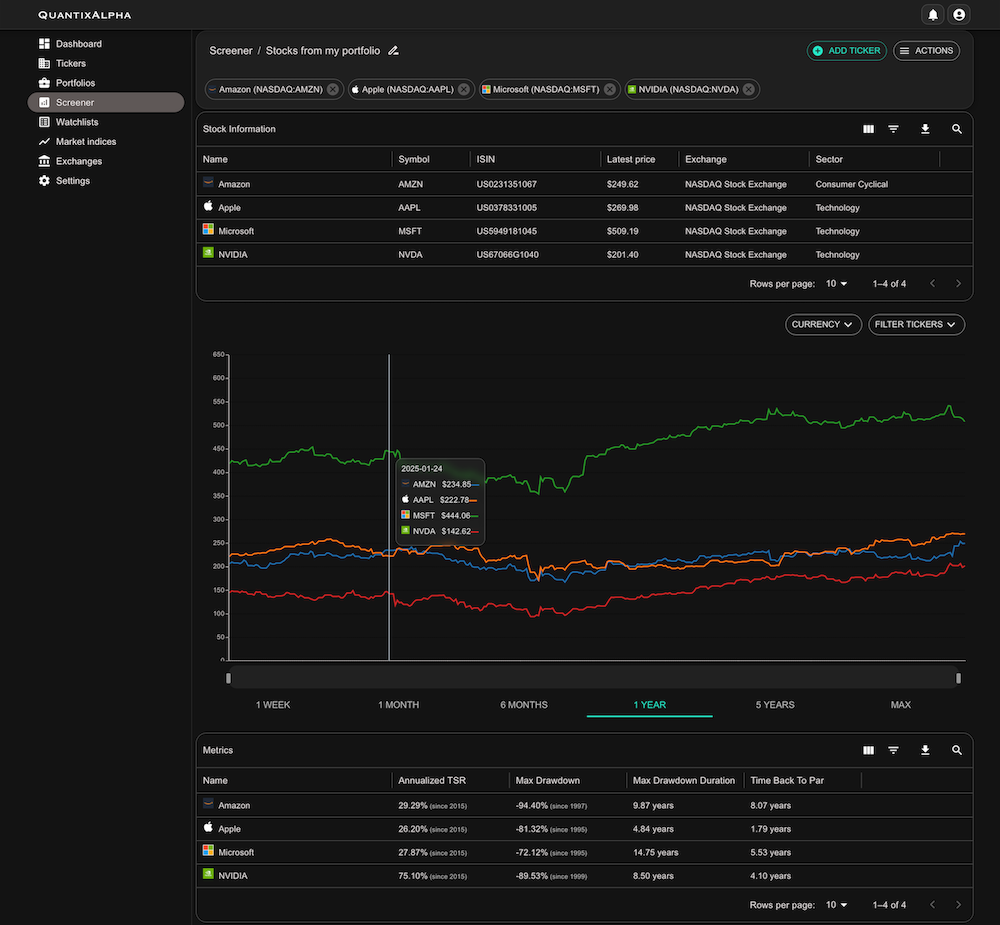

Historical Stock Price Data

View daily, weekly, or monthly closing prices, presented in interactive charts and downloadable tables.

Analyze trends over customizable time ranges, from the past week to decades of data.

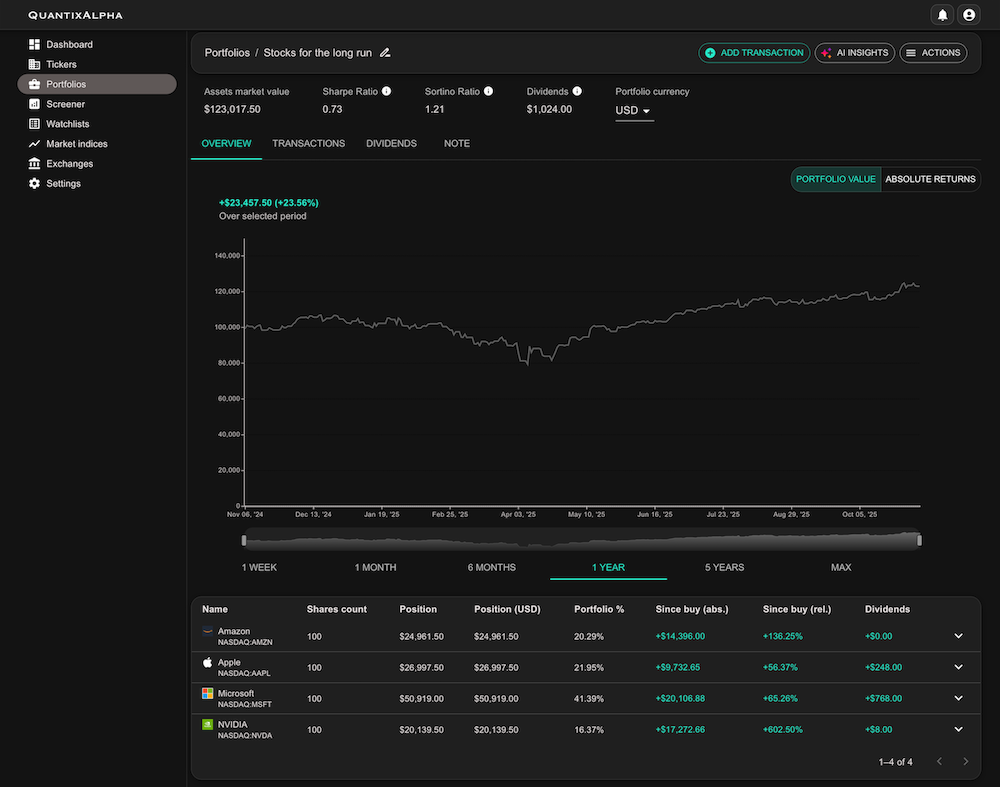

Stock Splits And Dividend History

Stay informed about past and upcoming stock splits, complete with split ratios, effective dates, and their

impact on historical pricing. Explore a full timeline of dividend payouts, including amount per share,

ex-dividend dates, payment dates, and yield calculations.

Latest News

Stay up-to-date with real-time news headlines, press releases, and SEC filings relevant to the selected

ticker.